Placemaking: the Game Changer Driving Asset Value and Repositioning in Real Estate

As it turns out, placemaking, although a concept that has been around for a while (thanks for this reminder @danielboffo), still fills an unquenched thirst at real estate conferences. I had the pleasure of joining some esteemed colleagues on a panel on Repositioning Existing Assets at the Vancouver Real Estate Strategy and Leasing Conference on Oct 29, 2019. The lens I decided to share expertise and insight on was placemaking as a repositioning strategy that has been proven to bring an edge and competitive advantage in the marketplace... AND demonstrate how, where and why with some example projects. This happens to be an area I have a ton of direct experience in and even more passion for because of the results it brings for value creation, both financial and non-financial, when done well.

As a topic that seems, either missing or often sidelined at real estate conferences over the last few years, I believe we are are missing a key area of focus to help us weather uncertain market conditions.

Placemaking, from a real estate perspective, is the interdisciplinary tactic to shape market demand and livability by enhancing the social, physical, cultural and economic qualities of a place. In essence it works like this..... the more vibrant the quality of a place and its amenities are, whether it is a building, a community or a neighbourhood, the more desirable that place becomes, and the more desirable a place becomes, the more likely that people want to be there, and the more people want to be there, the more likely it is that property values, lease rates, and revenues increase, and the more likely it is that vacancy rates decrease. Supported by a growing body of research and case studies, this just continues to be proven, over and over and over and over again for all asset classes of real estate.

Why is this concept growing in importance and why is place-making becoming a game changer for asset value and the real estate market??

It's quite simple. We all deeply seek connection and community, and more of it in our lives. We want to hang out and linger in places that make us feel good, and where other people are.

Once upon a time, our social recreation and activity happened in backyards but this is not the case anymore. People are searching for a sense of connection and community that is increasingly found in well-programmed public or semi-public spaces. With changing demographics and family structure, paired with increasing urbanization, people are seeking more and more spaces that can accommodate informal group and social activities. Think picnics, birthday parties, community events, places to hang out to work or read, business meetings, meeting up with friends, and spaces for fitness and recreation. This is becoming increasingly important and sometimes more important than unit sizes, interior finishes, layouts, and price point.

Below are some examples and projects I shared at the conference demonstrating place making as a key strategy for successful asset repositioning:

> SFO trend for many years in multi-unit rental buildings is small, very small, unit sizes with a strong focus on social interaction spaces, programming and art within and around the building. Less focus on the units and more focus on common, shared spaces and programming for social connection and community such as outdoor courtyards with BBQs and firepits, pet spas, and offering free cooking classes, continental breakfast and resident mixers each month.

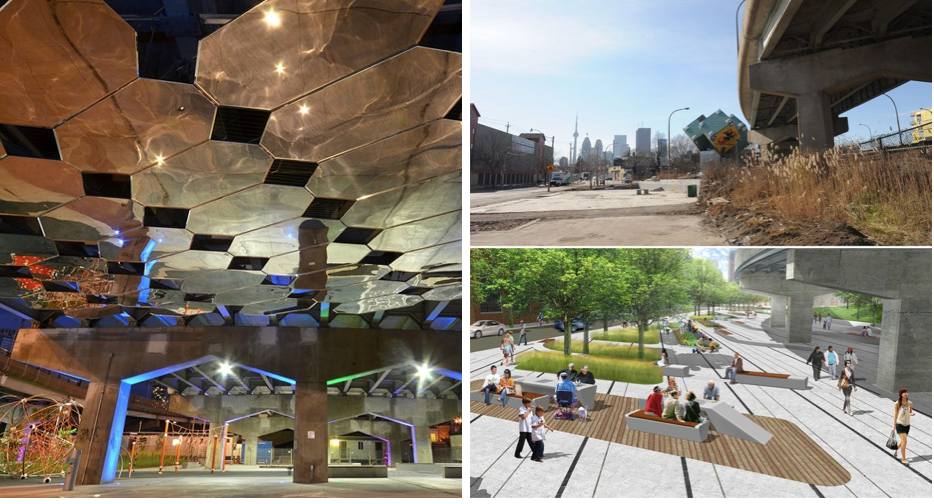

> Underpass park in Toronto was previously a derelict site under the Richmond-Adelaide overpass, adjacent to our first phase of development within the West Don Lands masterplan that I managed with Waterfront Toronto. We transformed this area into a 4 acre park before development occurred, to provide an amenity to the neighbourhood with a shortage of park space AND to add value to the adjacent development sites for phase 1 of the build out. The park was built first and used as a key and very effective marketing strategy for River City, the first phase of development. It created an unparalleled innovative park, the first of this kind of place in North America at the time and generated much celebration, awards, attention... all very effective for value creation for adjacent real estate.

> In Memphis, a placemaking project helped the long-vacant Tennessee Brewery Building find new life for a 1870s-era building at the edge of downtown was at risk of demolition in 2014. As a 6 week experiment, the brewery’s open-air courtyard into a pop-up beer garden and opened it to the public, showcasing how the building could be repurposed for future use. Branded as the “Tennessee Brewery Untapped,” the pop-up attracted thousands of people during its six-week run. As a result, the property subsequently was acquired and redeveloped into a mixed-use project with offices, housing, and ground-floor retail. An amazing and successful repositioning strategy for a derelict asset... because... place-making.

> In Brooklyn, this transformation of an ugly parking triangle of land into a fun and vibrant litte park, resulted in an increase in retail sales in the area businesses of 172% over a 3 year period. Just this small placemaking intervention. (Thank you to #stateofplace and @marielaalfonzo for this example!)

These examples are really a small few which are just the tip of the iceberg of the impact of placemaking on value creation and repositioning for real estate assets.

Want to add value to your existing land and building assets? Focus on place-making.

Want to increase your lease rates and revenues? Focus on place-making

Want a solid and proven repositioning strategy for better performance of your assets? Focus on place-making.

Want to drastically reduce commercial vacancy rates and attract high-quality tenants? Focus on place-making.

At the end of the day, the market is always unpredictable. But when we proactively adopt strategies that provide a competitive edge in the marketplace that we have direct control over, we can ensure that our real estate portfolios and assets stay strong and well- protected in fluctuating markets.